Nurturing an Investment Mindset for OFWs

Annually, millions of Filipinos look for job opportunities abroad to earn double or triple than what they would typically receive back home. Yet despite of getting bigger salaries, many Overseas Filipino Workers (OFWs) are anxious about never having enough. Simultaneously, they want to generously provide for their families’ daily needs and set aside enough for a comfortable retirement.

If you’re an OFW, you might ponder: how can I start earning for the future as well?

Just like anyone who wants to be financially independent, OFWs need to nurture an investment mindset.

Here are some tips to get you started.

1. Prioritize paying for the future

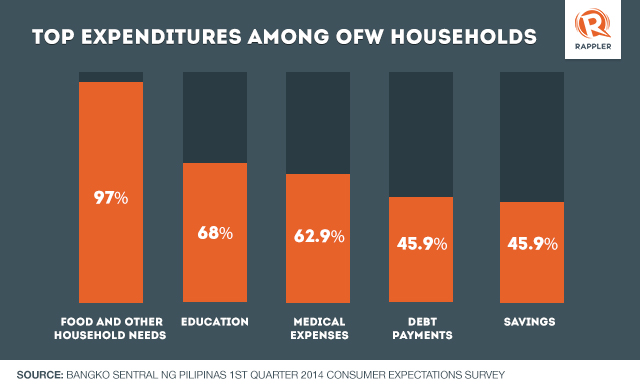

For the first quarter of 2014, the Bangko Sentral ng Pilipinas reported that OFW households used remittances for the following top items:

Despite earning more, majority of OFWs are settling debts rather than saving for the future. They are spending more for the present and the past. OFWs should learn how to save for the future too. Money will not last forever. Savings should be a top priority.

2. Create a budget plan that includes savings and investments

The most common habit of OFWs is to remit most of their earnings to their families. The head of the household then budgets this amount between expenses and savings. This can be affected by the pressure back home depending on their immediate needs and the mindset that more money will come next month anyway.

It is strongly recommended that OFWs properly apportion their hard-earned money. For a start, they can open another savings account that cannot be touched for household expenses. Or, they can build a stock investment portfolio as an alternative to secure the family’s future.

3. Take time learn about other forms of investment

In anticipation of retirement, many OFWs invest in tangible assets like real estate. They look forward to coming home and living in their dream house, or having it rented as a manageable source of income. However, investing in real estate also add up to years of mortgage and annual taxes. Calamities can reduce this solid investment into rubble.

OFWs must remember that all investments, tangible or not, has its risks. Spread your earnings into various forms of investments is a plausible way to control risks. As the quotation goes, “never put your eggs in one basket”.

4. Use online tools

The Internet is a blessing for overseas Filipinos – with the advent of video calls, social networking sites, and web-based messaging, it makes communication with loved ones stress-free. Today, it greatly helps the OFWs in managing their finances as major local banks have facilities for monitoring accounts and facilitating remittances online.

Likewise, placing your money in stocks has been made easy. Through online investment portals, like COL financial, OFWs can monitor and trade their own stocks whenever and wherever they are. With COL’s newly released mobile app, you can get real-time market quotes and info and quickly make trades.

5. Set achievable goals

Early retirement is common among OFWs as they desire to spend time and enjoy with their families. However, they should not be contented with simply sending enough every month. Instead of just having a plain savings goal, they must think of other sources of income to help achieve their targets.

Once OFWs and their families realize that every day brings them one step closer to a better life, making sacrifices is tolerable and spending wisely becomes easier in pursuit of bigger dreams.

(Source: Rappler.com – Nurturing an Investment Mindset for OFWs)