Oil Recovers from Eight-Week Low as OPEC Diplomats Work Overtime

Oil climbed after closing at an eight-week low in New York as OPEC members were said to be working to bridge a gap between producers and prices failed to hold declines below September lows.

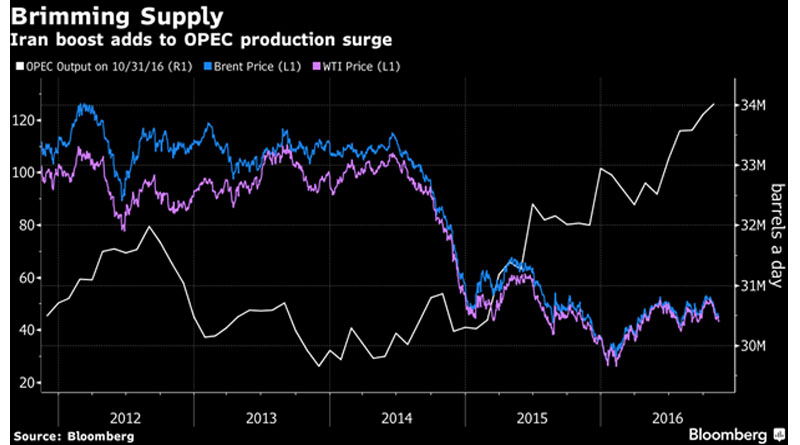

Prices sank as much as 2.8 percent earlier as Iranian output rose and the dollar surged to the highest since February. Iran boosted output at three fields faster than expected, while Saudi Arabia said the Organization of Petroleum Exporting Countries must agree to trim output to stabilize markets. Prices also dropped as the dollar rose to the highest level in more than nine months against its peers, making dollar-denominated commodities less appealing to investors.

Oil has retreated the past three weeks amid skepticism about OPEC’s ability to implement a deal at its Nov. 30 meeting in Vienna. The group needs to allocate production cuts to achieve a ceiling of 32.5 million to 33 million barrels a day. Failure may cause prices to slip further amid “relentless global supply growth,” the International Energy Agency said Nov. 10.

“The weak fundamental picture is the focus of the market right now,” said Gene McGillian, manager of market research for Tradition Energy in Stamford, Connecticut. “The Iranian headline about boosting production to 250,000 barrels a day at the western field is just the latest sign that supply is growing. Uncertainty about OPEC’s ability to make a cut has wiped out all of last month’s rally.”

West Texas Intermediate crude for December delivery traded at $43.68 a barrel at 4:53 p.m., after declining 9 cents to settle at $43.32 a barrel on the New York Mercantile Exchange. It was the lowest close since Sept. 19.

Support Level

“Support around $42.50 held,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. “Twice in September we were unable to break through support there, and it held today.”

Brent for January settlement fell 32 cents, or 0.7 percent, to $44.43 a barrel on the London-based ICE Futures Europe exchange. It’s the lowest close since Aug. 10. The global benchmark traded at a 49-cent premium to WTI for January delivery.

The dollar surged on bets that Donald Trump’s administration will ramp up spending, boosting economic growth and inflation and pushing the Federal Reserve to raise interest rates. The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, rose as much as 1 percent.

“The commodity markets don’t appear to be overly focused on Trump,” said Mike Wittner, head of oil-market research at Societe Generale SA in New York. “The stronger dollar is the one way that the election is having an impact.”

Iran has expanded output at three western fields to 250,000 barrels a day, from 65,000 in 2013, the Oil Ministry’s news service Shana reported. The nation told OPEC that it raised total production last month by 210,000 barrels a day to 3.92 million, the biggest increase since sanctions were lifted in January.

Saudi Comments

Saudi Arabia’s Energy Minister Khalid Al-Falih met Nov. 12 with his Algerian counterpart Noureddine Boutarfa and both are optimistic an output deal will be reached, the Algerian Energy Ministry said on an official Facebook page.

“While there may well still be an OPEC deal outcome in Vienna this month, it is expected to fall short of what is required to really kick-start the rebalancing process,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London.

OPEC members embarked on a final diplomatic effort to secure a deal on cuts, with Qatar, Algeria and Venezuela leading the push to overcome the divide between the group’s biggest producers, according to a delegate familiar with the talks. The behind-the-scenes diplomacy comes after bilateral meetings over the weekend failed to resolve the rifts, according to the delegate, who asked not to be identified because the discussions are private.

Oil-market news:

- Failure by OPEC to implement a deal could drag down crude to as low as $35 a barrel, while success at the group’s gathering in Vienna may push oil to $60, according to PIRA Energy Group Executive Chairman Gary Ross.

- China’s crude output slipped to the lowest in more than seven years, dropping 2.7 percent last month to about 3.795 million barrels a day, as oil’s sustained slump discouraged the restart of old wells.

- Global oil inventories are expanding at a slower pace as the market rebalances, according to Sanford C. Bernstein & Co.

(Source: Bloomberg.com)